How to Create a Cash Flow Forecast

Now that we understand the significance and advantages of cash flow forecasting, let’s dive into the practical aspect of creating one. Follow this step-by-step guide to develop an effective cash flow forecast tailored to your growing business:

Step 1: Gather Historical Data

Begin by collecting historical financial data, preferably covering the past 12 to 24 months. This data should include income statements, balance sheets, and cash flow statements. Analyzing historical cash flow patterns will provide valuable insights into your business’s financial behavior.

Step 2: Identify Revenue Sources

List all sources of revenue for your business. This includes sales, investments, loans, and any other income streams. Categorize these sources to ensure a comprehensive overview.

Step 3: Estimate Cash Inflows

Project your future cash inflows by considering factors such as sales projections, customer payment terms, and seasonal variations. Be realistic in your estimations, and remember to account for any anticipated changes in revenue streams.

Step 4: Outline Expenses

Compile a detailed list of all anticipated expenses, both fixed and variable. These may include rent, utilities, salaries, marketing costs, and loan repayments. Ensure accuracy by referring to historical data and considering future commitments.

Step 5: Account for Timing

Timing is crucial in cash flow forecasting. Different expenses and income sources may not align perfectly with your reporting periods. Factor in payment terms, billing cycles, and any delays or early payments.

Step 6: Calculate Net Cash Flow

Calculate your net cash flow by subtracting total anticipated expenses from total projected revenue for each period. This provides a clear picture of whether you expect a surplus or deficit.

Step 7: Monitor and Adjust

Cash flow forecasting is an ongoing process. Regularly monitor your actual cash flow against your forecasted figures. If discrepancies arise, identify the causes and adjust your forecasts accordingly. This flexibility ensures your forecast remains a reliable tool for decision-making.

Step 8: Plan for Contingencies

Prepare for unexpected events by including contingency plans in your cash flow forecast. Consider creating scenarios for best-case, worst-case, and most likely outcomes. This proactive approach helps you adapt swiftly to changing circumstances.

Step 9: Utilise Technology

Leverage accounting software or dedicated cash flow forecasting tools to streamline the process. These tools can automate data collection, provide real-time insights, and generate reports more efficiently.

Step 10: Seek Professional Guidance

If you’re unsure about creating a cash flow forecast or need assistance with complex financial scenarios, consider consulting with an accountant. Their expertise can provide valuable insights and ensure the accuracy of your forecasts.

Conclusion

By following this step-by-step guide, you’ll develop a robust cash flow forecast that serves as a vital tool for managing your growing business. With accurate financial projections, you can make informed decisions, navigate challenges, and seize opportunities, ultimately contributing to the sustained success of your enterprise.

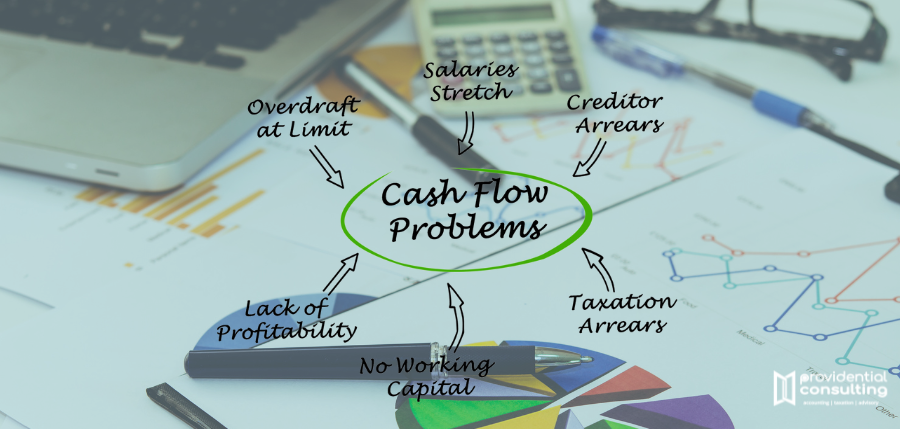

In the next section, we will explore common cash flow pitfalls to avoid, ensuring your forecast remains effective and reliable.

What To Do Next?

- You can complete our online form and we will call you.

- You can book an appointment to engage further.