What is Administrative Penalty?

An Administrative Penalty (Admin Penalty) is a penalty in accordance with the Tax Administration Act (TAA). The Act prescribes the various types of non-compliance which are subject to fixed administrative penalties.

The penalty is imposed only for non-submissions of tax returns in respect of individuals and companies:

- For individuals the penalty will be imposed where the taxpayer has failed to submit a return as and when required under the Income Tax Act for years of assessment commencing on or after 1 March 2006 where that person has two or more outstanding income tax returns for such years of assessment; and

- For companies the penalty will be imposed where the company has failed to submit an income tax return as and when required under the Income Tax Act for years of assessment ending during the 2009 and subsequent calendar years, where SARS has issued that company with a final demand referring to the public notice and requiring the submission of the outstanding income tax return, and the company failed to submit the return within 21 business days of the date of issue of the final demand.

Taxpayers who do not submit their tax returns will be charged an admin penalty which must be paid over to SARS.

Regardless of whether you agree or disagree with the admin penalty it is advisable to submit the outstanding return to stop further admin penalties. The penalty will reoccur for every month the return(s) remains outstanding for a maximum of 35 months.

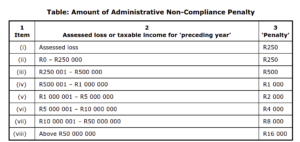

The administrative non-compliance penalty for the failure to submit a return comprises fixed amount penalties based on a taxpayer’s taxable income and can range from R250 up to R16 000 a month for each month that the non-compliance continues. Table below provides the way the penalties maybe levied.

What if I don’t agree with the Admin Penalty?

A Request for Remission (RFR) can be submitted when a taxpayer disputes any administrative penalty levied due to non-compliance. The taxpayer must provide reasons for the non-compliance for the request to be considered.

If the Request for Remission is disallowed or only a portion was selectively allowed, you may still object to the decision made by SARS and even appeal the decision if you disagree with the outcome of the objection process. Please refer to the Objections and Appeals page for more information on how to submit a dispute in respect of an Admin Penalty.

Please note that you cannot use the objections process before the RFR is submitted and considered.

When SARS is dealing with the RFR/objection/appeal, partial repayment may be allowed which means certain transactions may be settled.

How can I request an RFR (Request for remission)?

A Request for Remission form can be requested:

- Via eFiling for registered eFilers; or

- At a SARS branch.

How can I submit an RFR (Request for remission)?

A Request for Remission form can be submitted:

- Via eFiling for registered eFilers; or

- At a SARS branch.

How do I pay my Administration Penalty?

You can pay your administrative penalty using the foloowing payments channels:

- At the bank (SA major Banks); or

- via eFiling; or

- via EFT;

If you can’t make a full ‘once off’ payment to pay off the admininistrative penalty debt, you can make a deferred arrangement with SARS.

What will happen if I don’t pay my Administration Penalty?

If the Admin Penalty is not paid, SARS will appoint an agent (such as your employer) to collect the money on its behalf.

For more information you can visit SARS website.